42+ mortgage should be what percent of income

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Estimate your monthly mortgage payment.

How Much Of My Income Should Go Towards A Mortgage Payment

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Web The 2836 mortgage rule can be helpful for an individual because it is a commonly accepted standard. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Lock In Your Low Rate Today. Were not including any expenses in estimating the.

Ad Easier Qualification And Low Rates With Government Backed Security. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Ad Calculate and See How Much You Can Afford.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Ad Easier Qualification And Low Rates With Government Backed Security. John in the above example makes.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. When determining what percentage of.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. So taking into account homeowners insurance and property taxes.

Take Advantage of Low VA Loan Rates. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Web The 28 rule. It states that a. Apply Today and Get Pre-Approved In Minutes.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Compare Offers From Our Partners To Find One For You. Web The 2836 Rule is a commonly accepted guideline used in the US.

According to this rule a maximum of 28 of ones gross. Compare Offers From Our Partners To Find One For You. As a rule you should plan for closing costs to.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax. Web A 15-year term. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

And Canada to determine each households risk for conventional loans. Web What percentage of your monthly income should go to mortgage. Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume.

Ad See how much house you can afford. If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage. It is used by banks or other lenders when determining the.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Unfortunately closing costs vary widely by ones location mortgage broker and lender. Web Estimating Closing Costs.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your.

What Percentage Of Your Income To Spend On A Mortgage

Budget Percentages What Percentage Of Your Income Should Go To

What Percentage Of Your Income Should Go To Your Mortgage Hometap

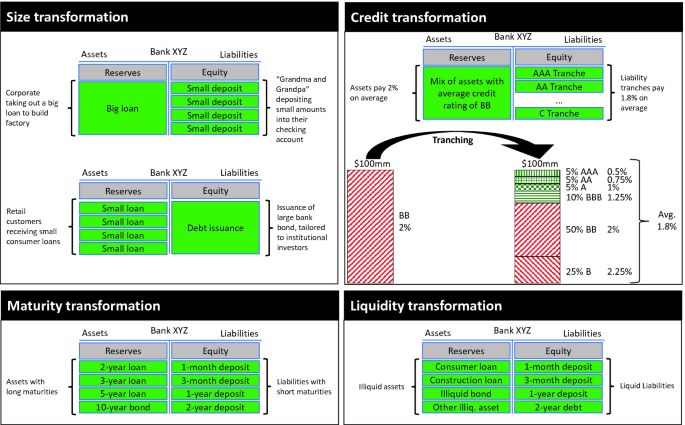

Fundamentals Of The Banking Business Springerlink

How Much Of My Income Should Go Towards A Mortgage Payment

Test By Giladn Issuu

What Percentage Of Your Income Should Go Toward Your Mortgage

28ac Rr 3 Winfield Road Fairmont Wv 26554 Mls 10139859 Howard Hanna

Eawczdace00mlm

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

How To Find Out If You Can Afford Your Dream Home

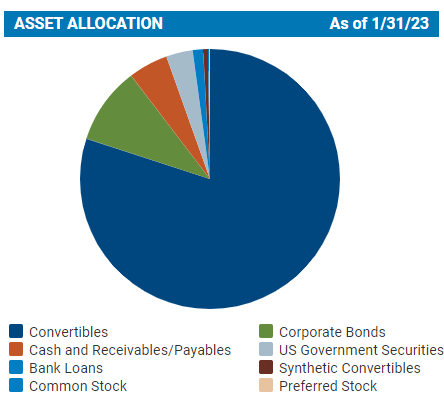

Abraxasdecember2016catal

42 Sample Budget Checklists In Pdf Ms Word

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Of My Income Should Go Towards A Mortgage Payment